nh property tax calculator

To use our New Hampshire Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Enter as a whole number without spaces dollar sign or comma.

States With The Highest And Lowest Property Taxes Property Tax States High Low

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

. Although the Department makes every effort to ensure the accuracy of data and information. Manchester NH 03101. Assessed Value The assessed value multiplied by the real estate tax rate equals the real estate tax.

The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the NH property tax calculator. The assessed value multiplied by the tax rate equals the annual real estate tax. Estimate Property Tax Our New Hampshire Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in New Hampshire and across the entire United States.

New Hampshire Property Tax Calculator - SmartAsset New Hampshire Property Tax Calculator Overview of New Hampshire Taxes New Hampshire is known as a low-tax state. New Hampshire Real Estate Transfer Tax Calculator The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value.

Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only. Pro-ration of Real Estate Taxes. After a few seconds you will be provided with a full breakdown of the tax you are paying.

January 1 2021 Our Tax Expert Find a Savings or CD account that works for you Taxes can really put a dent in your paycheck. Enter your Assessed Property Value Calculate Tax 2021 Taxes The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to. 186 of home value Tax amount varies by county The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

Assessing Tax Calculator The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value. For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. Property tax is calculated based on your home value and the property tax rate.

The result is the tax bill for the year. 179 of home value Yearly median tax in Hillsborough County The median property tax in Hillsborough County New Hampshire is 4839 per year for a home worth the median value of 269900. Chairman of the Assessors office Robert Gagne said the calculation will estimate the potential change in an owners property taxes due.

NEW -- New Hampshire Real Estate Transfer Tax Calculator. The Property Tax process of assessment collection tax liens deeding interest rates and additional fees are controlled by NH State Statutes and references by RSA are annotated. Estimate of Property Tax Owed.

681 Salem Church Road Reidsville NC 27320 in 2020 What is the tax year. Assessing department tax calculator. Brenda Masewic Adams TC Tax Collector.

Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as. But while the state has no personal income tax and no sales tax it has the fourth-highest property tax rates of any US. Hillsborough County New Hampshire Property Tax Go To Different County 483900 Avg.

Property Tax Calculator Real Estate Tax Rate The current real estate tax rate for the City of Franklin NH is 2321 per 1000 of your propertys assessed value. City of Manchester Tax Collectors Office PO BOX 9598 Manchester NH 03108. 2013 City of Concord NH.

Figuring Taxes New Hampshires tax year runs from April 1 through March 31. Taxpayer Assistance - Overview of New Hampshire Taxes It is the intent of the New Hampshire Department of Revenue Administration that this publication be for general tax information purposes and therefore should not be construed to be a complete discussion of all aspects of these tax laws. State Education Property Tax Warrant.

The assessed value multiplied by the real estate tax rate equals the real estate tax. Voted Appropriations minus All Other Revenue divided by Local Assessed Property Value Rate Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated. But with a Savings or CD account you can let your money work for you.

2013 NH Tax Rates 2014 NH Tax Rates. 2021 NH Property Tax Rates 15 15 to 25 25 to 30 30 Click or touch any marker on the map below for more info about that towns property tax rates. New Hampshire Property Tax Calculator to calculate the property tax for your home or investment asset.

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value. The 2020 real estate tax rate for the town of stratham nh is 1895 per 1000 of your propertys assessed value. If you would like an estimate of what the property taxes will be please enter your property assessment in the field below.

MANCHESTER NH In an effort to help property owners estimate what the recent revaluations will mean to them in dollars and cents the city Assessors office has created a Tax Change Calculator now available on their website. State with an average effective rate of 205. If you would like an estimate of the property tax owed please enter your property assessment in the field below.

The current real estate tax rate for the city of franklin nh is 2284 per 1000 of your propertys assessed value. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by 1000. The City of Dover is not involved with the pro-ration of real estate taxes between a buyer and a seller of.

Property Tax 5657 Total Estimated Tax Burden 15765 Percent of income to taxes 28 15765 About This Answer Last Updated. The median property tax in new hampshire is 463600 per year for a home worth the median value of 24970000. Online Property Tax Calculator Enter your Assessed Property Value in dollars - Example.

Nh property tax calculator.

The States With The Highest Corporate Income Tax Collections Per Capita Are New Hampshire Massachusetts California Alaska An Income Tax Business Tax Income

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

South Carolina Property Tax Calculator Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

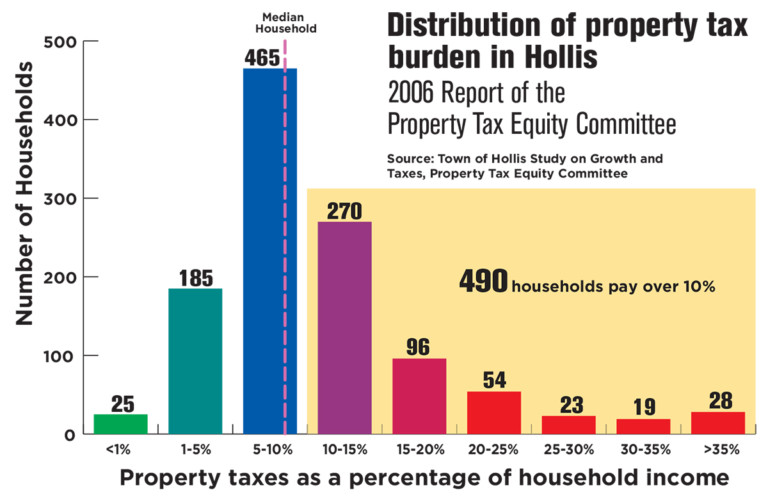

Does New Hampshire Love The Property Tax Nh Business Review

When 30 000 Property Taxes Hit A Little Harder Cnn Business Real Estate Articles Estate Agent Real Estate Companies

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

New Hampshire Property Tax Calculator Smartasset

Rent Vs Buy Calculator Is It Better To Rent Or Buy Smartasset Com Retirement Calculator Property Tax Financial

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

Monday Map State Local Property Tax Collections Per Capita Teaching Government Property Tax Map

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Retirement Income Best Places To Retire Retirement Locations

10 Most Tax Friendly States For Retirees Retirement Advice Retirement Tax

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

State Local Property Tax Collections Per Capita Tax Foundation

Mapsontheweb Infographic Map Map Sales Tax

South Carolina Property Tax Calculator Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

State And Local Sales Tax Rates 2013 Income Tax Property Tax Map

Secrets Of Tax Lien Investing Tax Sale Investment Type Tax Lien States Tax Deed States And Redemption Deed States Tax Help Tax Prep Tax Preparation

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average